Offshore Trustee Solutions for International Riches Administration

Beyond Boundaries: Optimizing Financial Privacy and Security With Offshore Trust Fund Solutions

Are you looking to optimize your financial privacy and security? Look no more than overseas count on services. In this article, we will certainly explore the value of offshore trust funds for financial personal privacy and describe the legal structure that governs these services. Discover the benefits and advantages of using offshore counts on for added safety, and gain insights right into choosing the appropriate offshore trust supplier. Obtain prepared to check out approaches that will certainly assist guard your assets throughout borders.

The Relevance of Offshore Trusts for Financial Privacy

Among the vital benefits of offshore trusts is the ability to keep your economic info confidential. Unlike standard onshore trusts, offshore depends on offer a higher level of privacy and discernment. These jurisdictions have rigorous regulations in position that protect the identification of the trust's beneficiaries, ensuring that their monetary events continue to be confidential.

In enhancement to discretion, offshore depends on provide protection against possible lawful claims and lenders. By relocating your properties offshore, you can create a legal barrier that makes it hard for litigators or lenders to confiscate your wide range. This added layer of protection can provide assurance and secure your economic future.

Additionally, overseas depends on can additionally give tax advantages. Many offshore jurisdictions offer beneficial tax obligation regimes that allow you to minimize your tax liabilities legally - offshore trustee. By strategically structuring your count on, you can make the most of these tax benefits, potentially saving significant amounts of cash

Recognizing the Lawful Structure for Offshore Depend On Solutions

Comprehending the legal framework for offshore trust services can aid you shield your properties and make sure conformity with appropriate regulations. Offshore counts on are subject to a set of regulations and guidelines that regulate their establishment and procedure. These regulations differ from jurisdiction to jurisdiction, so it is vital to familiarize yourself with the details legal needs of the offshore jurisdiction in which you intend to develop your trust.

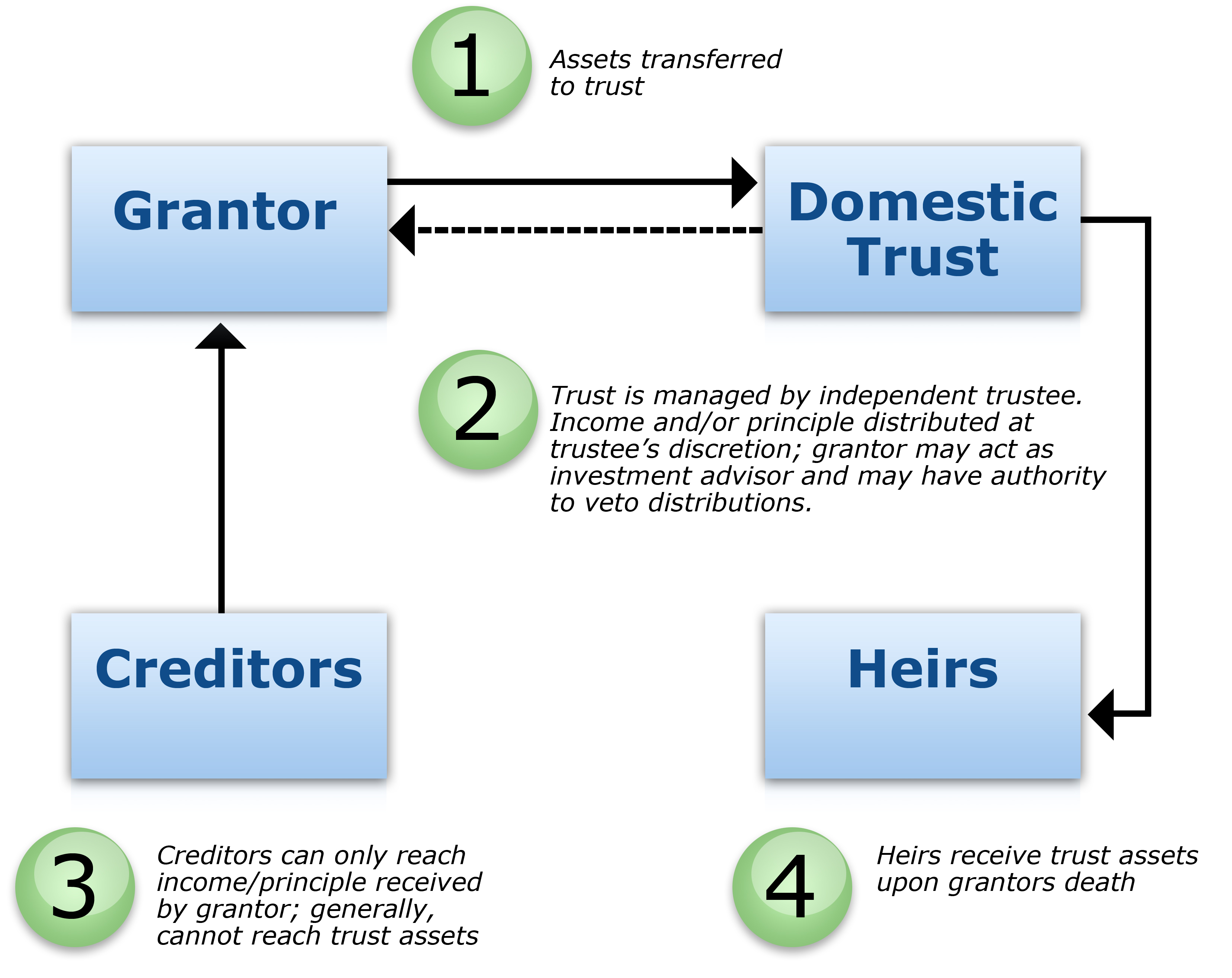

One important facet of the legal structure for overseas counts on is the principle of possession protection. Offshore trusts are frequently utilized as a means to secure assets from legal cases or prospective financial institutions. By positioning your properties in an offshore trust, you can produce a legal obstacle that makes it extra tough for creditors to gain access to and take your properties.

Another trick component of the lawful structure is tax obligation preparation. Several overseas jurisdictions use beneficial tax obligation regimes, enabling you to decrease your tax responsibility and maximize your financial returns. It is crucial to recognize the tax legislations of both your home nation and the overseas territory to ensure compliance with all appropriate tax guidelines.

In addition, offshore count on services go through anti-money laundering (AML) and know-your-customer (KYC) laws. These regulations aim to avoid money laundering, terrorist financing, and various other immoral tasks. Recognizing and sticking to these regulations is vital to preserving the authenticity and honesty of your offshore count on.

Benefits and Advantages of Utilizing Offshore Counts On for Protection

An additional advantage of using overseas trust funds is the asset protection they supply. By moving your properties into a trust fund located in a jurisdiction with strong asset protection regulations, you can protect your wealth from lenders, suits, and various other economic dangers. This can offer you assurance knowing that your assets are protected and secured.

In addition, overseas depends on can use tax benefits. Some jurisdictions supply desirable tax obligation routines, permitting you to possibly lower your tax obligation obligation. By try these out structuring your assets in a tax-efficient manner, you can legitimately lessen your tax obligations and preserve even more of your wealth.

Lastly, overseas counts on can also give estate preparation benefits. By developing a trust fund, you can make sure that your assets are dispersed according to your desires, also after your death (offshore trustee). This can help stay clear of probate and prolonged lawful procedures, making sure a smooth transfer of wealth to your recipients

Secret Considerations When Picking an Offshore Depend On Service Provider

To guarantee a successful choice process, you should extensively study and examine prospective offshore count on suppliers based on their experience, credibility, and proficiency. When it comes to securing your monetary assets and optimizing your personal privacy, choosing the right offshore depend on provider is essential.

Look for a company with a tried and tested track record of success in taking care of overseas counts on. Make sure the carrier has a deep understanding of the legal and monetary ins and outs entailed in offshore trust services.

Moreover, it is important to evaluate the array of solutions offered by each supplier - offshore trustee. this hyperlink Establish whether they can meet your particular requirements and goals. Consider their ability to supply customized remedies that align with your financial goals

Finally, do not neglect to evaluate the service provider's client service. You wish to choose a service provider that is receptive, trustworthy, and devoted to your satisfaction. Take the time to talk with their representatives and ask concerns to evaluate their level of expertise and listening.

Discovering Strategies to Safeguard Your Assets With Offshore Trusts

To explore strategies for safeguarding your assets with overseas trust funds, take into consideration talking to an economic expert that concentrates on global riches administration. They can direct you through the process and aid you make educated choices. One technique is to diversify your properties dig this geographically. By positioning several of your riches in offshore trusts, you can protect it from possible dangers in your home country. Offshore trust funds use improved privacy and property protection, protecting your assets from legal actions, financial institutions, and other financial threats. Furthermore, you can also take advantage of tax benefits by establishing an offshore depend on. Some territories provide favorable tax obligation policies, permitting you to reduce your tax obligation responsibilities legally. One more strategy is to develop a trust guard. This private or entity ensures that the trustee complies with the terms of the depend on and acts in your benefits. They have the power to remove or change the trustee if essential. Offshore depends on can provide estate planning advantages. By placing your properties in a trust, you can dictate how they will certainly be handled and dispersed after your fatality, making certain that your liked ones are taken care of according to your wishes. In general, offshore trust funds can be a beneficial tool for securing your assets and making best use of economic personal privacy and safety and security. Consulting with a monetary expert who concentrates on global wealth management is vital to browse the intricacies and take advantage of these strategies.

Conclusion

In conclusion, making use of overseas count on services is important for maximizing your monetary personal privacy and safety. By comprehending the legal structure and choosing a reputable offshore trust fund carrier, you can gain from the advantages they use. Safeguarding your assets becomes much easier with overseas counts on, allowing you to protect your riches beyond borders. Don't wait to explore this technique and make certain the privacy and safety and security of your monetary events.

Discover the benefits and benefits of making use of offshore trust funds for added protection, and gain insights into selecting the appropriate overseas count on carrier. Unlike conventional onshore depends on, offshore trust funds offer a higher degree of privacy and discernment. By positioning your properties in an offshore count on, you can produce a lawful obstacle that makes it extra difficult for creditors to gain access to and take your assets.

By placing your possessions in an offshore depend on, you can maintain your individual and economic details personal, as these trust funds are subject to strict privacy laws and regulations. Offshore trusts provide enhanced privacy and asset protection, shielding your properties from lawsuits, financial institutions, and various other economic threats.